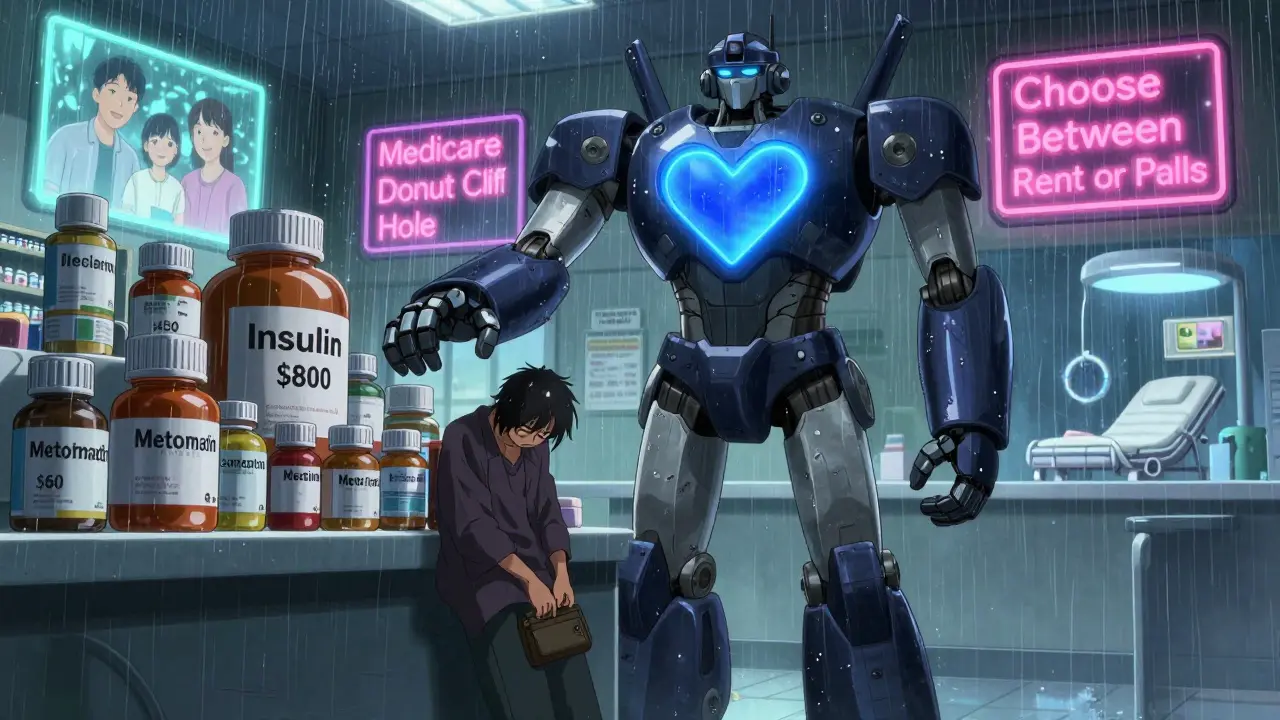

Every year, medication adherence saves lives. But for millions, taking pills as prescribed isn’t a choice-it’s a financial gamble. If you’ve ever skipped a dose because the price at the pharmacy was too high, you’re not alone. In 2021, nearly 1 in 12 American adults aged 18-64 didn’t fill a prescription or cut their dose because of cost. For older adults on Medicare, it’s even worse: 1 in 7 still skip meds to pay for food or rent. This isn’t just about money-it’s about survival.

Why Cost Stops People from Taking Their Medication

It’s not laziness. It’s not forgetfulness. It’s the bill. High copays, deductibles, and coinsurance turn life-saving drugs into luxury items. A 2023 study in the American Journal of Managed Care found that when a monthly copay jumped from $10 to over $50, adherence dropped by 15-20%. That’s not a small dip-it’s a cliff. People don’t just delay refills. They split pills in half. They take every other day. They stop cold.

Cardiovascular drugs are especially vulnerable. Patients with high blood pressure or cholesterol often skip doses because they don’t feel sick-until they have a heart attack. Meanwhile, insulin users pay hundreds a month even with insurance. One Reddit user shared paying $800 monthly for insulin despite having coverage. That’s not rare. It’s standard.

The problem isn’t just private insurance. Medicare Part D was supposed to help seniors, but the coverage gap-known as the “donut hole”-left many paying thousands out of pocket. Even now, 18% of all U.S. adults say they didn’t fill a prescription last year because of cost. And it’s worse for low-income families. People earning under $25,000 a year are over three times more likely to skip meds than those earning over $75,000.

What Happens When People Don’t Take Their Meds

Skipping pills doesn’t just make you feel worse. It kills. The American Heart Association estimates that medication non-adherence causes around 125,000 deaths in the U.S. every year. That’s more than traffic accidents. It’s also a financial disaster for the system. Non-adherence adds $100-$300 billion in avoidable hospital visits, ER trips, and complications annually.

Think about someone with diabetes. If they skip metformin because it’s $60 a month, their blood sugar spikes. They end up in the ER with ketoacidosis. The hospital bill? $15,000. The cost of the pills? $720 a year. That’s not a savings. That’s a trap.

And it’s not just physical health. Mental health meds like antidepressants or antipsychotics are often abandoned when costs rise. People feel better for a few weeks, then stop because they can’t afford the next refill. Then the depression comes back-worse than before. The cycle repeats.

How to Get Help: Real Solutions That Work

There are ways out. You don’t have to choose between medicine and groceries. Here’s what actually works:

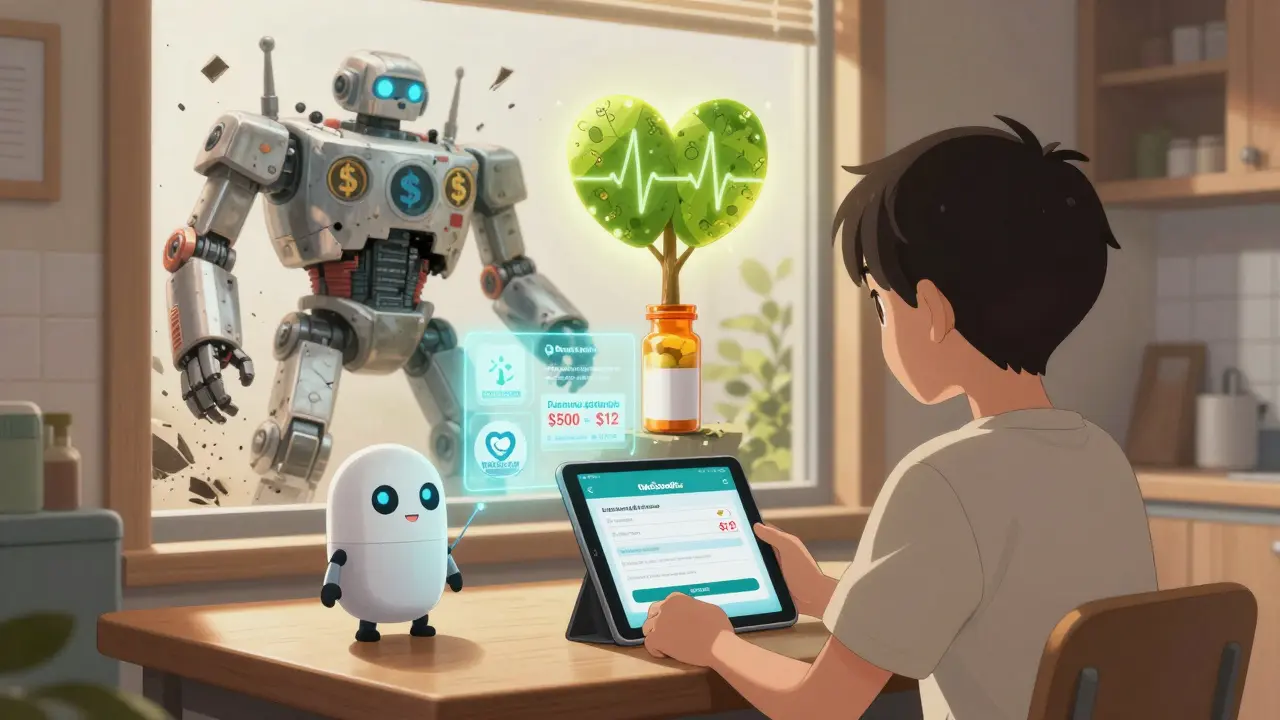

- Ask your doctor for alternatives. Not every brand-name drug is necessary. Generic versions can cost 80% less. In 2022, the FDA approved over 1,100 new generics. Ask if your prescription has a cheaper, equally effective version.

- Use GoodRx or SingleCare. These free apps compare prices at nearby pharmacies. One user saved $400 on her blood pressure med by switching from her local CVS to a Walmart that offered it for $12. These tools can cut costs by 50-80%.

- Apply for patient assistance programs. Drug manufacturers offer free or low-cost meds to people with low income. Eligibility? Usually under 400% of the federal poverty level-that’s $55,520 for one person in 2023. Over 1.8 million Americans used these programs in 2022. One type 2 diabetes patient dropped her insulin cost from $500 to $25 a month after enrolling.

- Ask for a 90-day supply. Many insurers charge less per pill for a 3-month supply. Mail-order pharmacies often offer this. You save 20-30% and avoid monthly trips to the pharmacy.

- Check if you qualify for Medicare’s Extra Help. If you’re on Medicare and have limited income, this program can cover up to $5,000 in drug costs a year. It’s automatic for those on Medicaid, but others must apply through Social Security.

- Request free samples. Doctors still have samples. If you’re struggling to pay, just ask. A 2022 survey found 32% of cost-conscious patients got help this way.

Don’t wait until you’re out of pills. Talk to your doctor before you fill your first prescription. Say: “I’m worried I won’t be able to afford this. Can we find something cheaper?” Most doctors will listen. In fact, 65% of physicians now routinely ask about cost-up from 42% in 2019.

New Laws Are Changing the Game (Starting in 2025)

Big changes are coming. The Inflation Reduction Act of 2022 is finally rolling out. Starting in 2025, Medicare beneficiaries will never pay more than $2,000 a year for prescription drugs-no matter how expensive the meds. The “donut hole” is gone. And for the first time, high-cost drugs like insulin will be capped at $35 a month for Medicare users.

There’s also a new payment plan called M3P (Medicare Monthly Payment Plan). If your drug costs over $400 a month, you can pay it in installments instead of all at once. No more shock at the counter.

These aren’t just policy changes. They’re life-saving fixes. Before 2025, many seniors chose between insulin and heating their homes. After 2025, they won’t have to.

What Still Isn’t Fixed

Even with these wins, the system is still broken. Real-time benefit tools-apps that show drug prices during doctor visits-are supposed to help. But a 2022 study found that 37% of the prices they show are wrong by more than $10. That’s not helpful. It’s misleading.

And while insulin prices are capped for Medicare users, private insurance patients still pay hundreds. The list price of insulin rose 368% between 2007 and 2017. Production costs didn’t change. The profit did.

Pharmaceutical companies still control pricing. And until that changes, cost will remain the biggest barrier to medication adherence.

What You Can Do Right Now

Don’t wait for the system to fix itself. Take action today:

- Write down every medication you take, including dosage and cost.

- Check GoodRx for each one. See if a pharmacy nearby offers it cheaper.

- Call your doctor’s office. Ask if they have samples or can switch you to a generic.

- Visit Partnership for Prescription Assistance or call 1-888-477-2669. They’ll match you to free or low-cost programs.

- If you’re on Medicare, go to Medicare.gov and apply for Extra Help. It takes 10 minutes.

You don’t need to be an expert. You just need to ask. The system isn’t perfect, but the tools to get help are out there. Use them.

Why do people skip doses even when they know it’s dangerous?

Most people don’t skip doses because they’re careless-they do it because they can’t afford them. A 2021 CDC survey found that 8.2% of adults under 65 didn’t take their meds as prescribed due to cost. Many report choosing between medicine, food, rent, or transportation. It’s not ignorance-it’s survival.

Can I really get insulin for $35 a month?

Yes-if you’re on Medicare. Starting in 2023, Medicare caps insulin at $35 per month. In 2025, that cap will extend to all Part D plans. Some private insurers and drugmakers already offer it. Check with your pharmacy or manufacturer’s patient assistance program. Even if you’re not on Medicare, programs like GoodRx or manufacturer coupons can bring insulin down to $25-$40.

Are generic drugs as effective as brand names?

Yes. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand name. They’re tested to be bioequivalent. The only differences are inactive ingredients like fillers or dyes, which rarely affect how the drug works. Most doctors agree: generics are just as safe and effective.

What if my doctor won’t switch my prescription?

If your doctor says no, ask why. Is it because they think the brand is better? Ask for evidence. If they’re concerned about effectiveness, request a trial of the generic with a follow-up. If it’s insurance-related, ask them to check your formulary. Many doctors don’t realize how much cheaper alternatives exist. You have the right to ask for affordable options.

How do I know if I qualify for patient assistance programs?

Most programs require your income to be below 400% of the federal poverty level-about $55,520 for one person in 2023. You’ll need proof of income (pay stubs, tax return, or a signed letter). Some programs also require a doctor’s note confirming you’re on the medication. The Partnership for Prescription Assistance (PPA) can help you find the right program in minutes. Visit pparx.org or call 1-888-477-2669.

Can I get help if I have private insurance?

Absolutely. Even with private insurance, your plan may have high copays or exclude certain drugs. GoodRx and SingleCare work with most pharmacies regardless of insurance. You can also apply for manufacturer coupons or patient assistance programs. Many drugmakers offer discounts even to those with insurance if your out-of-pocket cost is too high.

Is it safe to split pills to save money?

Sometimes-but only if your doctor says it’s okay. Some pills, like extended-release or capsule forms, shouldn’t be split. Others, like high blood pressure or cholesterol pills, are often scored and safe to split. Always check with your pharmacist or prescriber before splitting. Never split insulin, antibiotics, or chemotherapy drugs. The risk of uneven dosing can be dangerous.

What’s the difference between GoodRx and SingleCare?

Both are free price-comparison tools that work like coupons. GoodRx tends to have more pharmacy partners and more detailed pricing. SingleCare sometimes offers lower prices on specific drugs and has a simpler interface. Try both. Prices vary by location and pharmacy. One drug might be cheaper on GoodRx, another on SingleCare. Neither replaces insurance, but both can save you hundreds.

Final Thought: You’re Not Alone

Medication adherence isn’t about willpower. It’s about access. If you’re skipping doses because of cost, it’s not your fault. The system is stacked against you. But you’re not powerless. Help exists. Programs are waiting. Prices are falling. And with the new 2025 Medicare caps, things are finally moving in the right direction.

Start today. Write down your meds. Call your doctor. Check GoodRx. Apply for assistance. One small step can mean the difference between getting better-and getting worse.

Ellie Stretshberry

December 26, 2025 AT 17:28i just skipped my blood pressure med last month because i had to choose between that and gas to get to work. i didn't feel bad at first but then i got dizzy at the grocery store and almost fell. now i use goodrx and found a walmart that sells it for $8. not perfect but better than nothing.

Dan Alatepe

December 26, 2025 AT 18:04yo this is wild. in nigeria we just buy meds from street vendors sometimes because the pharmacy charges 3x what it should. i saw a guy buy insulin for $12 in a market near abuja. no prescription. no label. just a little vial in a plastic bag. people die like this every day. but hey at least we don't have to fight with insurance companies 😅

Zina Constantin

December 27, 2025 AT 03:12thank you for writing this. as someone who works with elderly patients in rural america, i see this every single day. one woman told me she splits her cholesterol pill because she can’t afford the refill - and she’s been doing it for 4 years. she’s not lazy. she’s surviving. the fact that insulin is now capped at $35 for medicare is a miracle. but we still have so far to go. please share this with someone who needs it. you might save a life.

christian ebongue

December 28, 2025 AT 00:44generic drugs work. period. my doc switched me from brand-name lisinopril to the generic. same pill. same results. $12 vs $120. i didn't even notice. why are we still paying for brand names? 🤦♂️

Angela Spagnolo

December 29, 2025 AT 00:02i... i didn't know about the extra help program... i've been on medicare for 3 years... and i've been paying $400 a month for my diabetes meds... i just applied... i'm crying right now... thank you for telling people about this...

Shreyash Gupta

December 30, 2025 AT 12:08so let me get this straight - you're telling me that people are dying because they can't afford pills... but the solution is to use a coupon app? lol. this is like handing someone a bandaid while their house is on fire. the real problem is pharma monopolies. fix that. not your grocery savings.

Sarah Holmes

January 1, 2026 AT 09:34It is profoundly immoral that human life is subject to the whims of corporate profit margins. The pharmaceutical industry operates with the moral bankruptcy of a cartel, and the regulatory bodies are complicit. This is not a 'cost issue' - it is a systemic atrocity. The fact that you are being told to 'ask your doctor' or 'use GoodRx' is a grotesque minimization of institutionalized cruelty. The system is not broken - it is functioning exactly as designed.

Jody Kennedy

January 2, 2026 AT 07:27you're not alone. i used to skip my antidepressants because they cost $180. then i found a patient assistance program - now i pay $5. i'm alive because i asked. if you're reading this and you're struggling - please, just call your doctor's office. they'll help. i promise.